Two Types of NPI

Many healthcare providers don’t realize that there are actually two types of NPIs. The CMS (Centers for Medicare and Medicaid Services) describes them like this.

- Type 1: Healthcare providers who are individuals, including physicians, dentists, and all sole proprietors. An individual is eligible for only one NPI.

- Type 2: Healthcare providers who are organizations, including physician groups, hospitals, nursing homes, and the corporation formed when an individual incorporates him/herself into a group practice.

If you are an individual doctor or solo practitioner, you will need to start with a Type 1 NPI. Your individual NPI is akin to your social security number. It is a personal identifying number for you as an individual healthcare provider.

A Type 2 NPI is for group practices from large to small. Most group practices that supply superbills to their patients should have a Type 2 NPI. In some cases, even if you are the only healthcare provider in your practice it may be necessary to have a Type 2 NPI for your practice. For example, Florida Blue will only accept superbills with a EIN if the EIN is tied to a Type 2 NPI in their out-of-network provider database.

The purpose of the two types of NPIs becomes clear if you think about them in the context of a patient receiving treatment in a large hospital. The insurance company not only wants to know which particular hospital the patient visited as identified by the NPI Type 2, but also which of the many hundreds of doctors who work there actually saw the patient, identified by their individual Type 1 NPI.

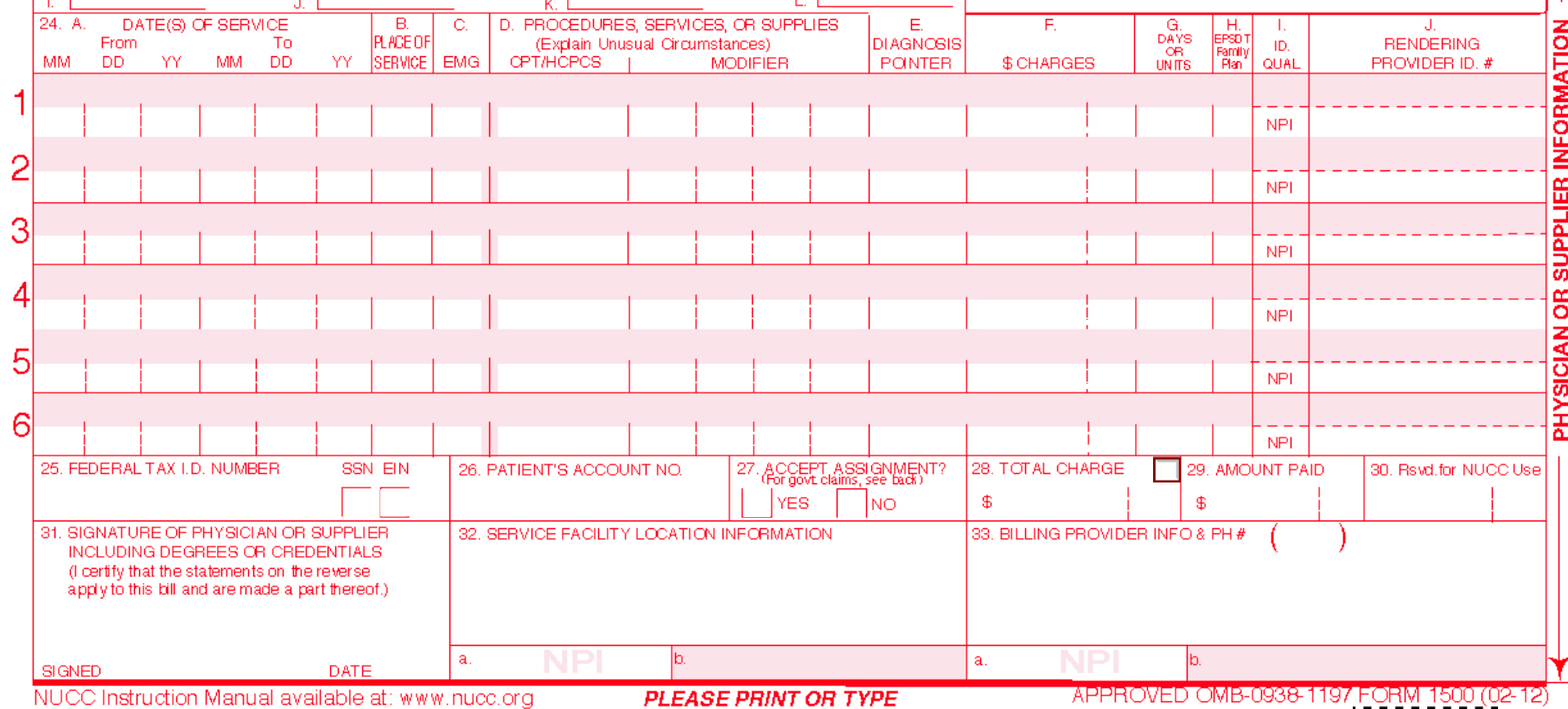

You can see this in practice on the standard CMS -1500 claim form. You will notice that there are spaces for both types of NPI on the form. Box 24J (Rendering Provider ID#) is the space where you enter the Type 1,or individual NPI, and Box 33A (Billing Provider NPI) is the space where you enter the Type 2, or group NPI.

Many small group practices commonly only include a Type 2 or group NPI on their superbills. It is very common that health insurance companies will not be able to process these claims because the individual rendering provider that treated the patient is not sufficiently identified on the claim. From the point of view of an insurance company, it is not the group that provides the care but the individual licensed healthcare provider. To successfully process the claim, the insurance company wants both pieces of information.